The only time debt makes you richer is when you use it to buy assets

When most people hear the word debt, they think of something that weighs them down — credit cards, car loans, student loans, or anything that drains monthly cash flow. But in real estate, the story changes. The right kind of debt, used strategically, becomes a tool to build long-term wealth.

That tool is leverage.

Carl White often calls leverage “the great multiplier,” because it allows everyday families to benefit from the growth of a large asset — even when they only invested a small amount upfront. Dave Savage explains it simply: leverage is “controlling a big asset with a small amount of money.”

And that one concept is why homeowners, on average, outpace renters in wealth by nearly 40x nationwide. Real estate gives you the ability to participate in asset growth that you couldn’t touch through saving alone.

How Leverage Creates Wealth

-

1

You Control a Large Asset With a Small Down Payment

Let’s say you put 5% down on a $400,000 home. You invest $20,000, but you now control a $400,000 asset. You get all the benefits of ownership — stability, tax advantages, and long-term appreciation — without needing the full purchase price in cash.

-

2

Appreciation Works on the Full Value

If that $400,000 home appreciates by 3% in a year, that’s $12,000 in value gained.

You didn’t earn 3% on your $20,000 down payment…

You earned $12,000 on a $20,000 investment — a 60% return based purely on appreciation. -

3

Inflation Reduces the Real Cost of Your Debt

While everyday prices rise over time, your 30-year fixed mortgage does not. That means every year, the real cost of your payment decreases as your income typically increases. Rent rises. Mortgage payments stay steady. That difference alone becomes a wealth-builder.

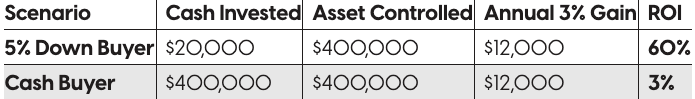

5% Down vs Cash Buyer (Illustrative Only)

Actual results vary.

Example: The Leverage Advantage

Imagine two buyers purchasing the same $400,000 home.

- Buyer A puts 5% down ($20,000).

- Buyer B pays cash ($400,000).

Both buyers experience the same 3% home appreciation, gaining $12,000 in equity. But the return on their investment is drastically different:

- Buyer A made $12,000 on $20,000 invested.

- Buyer B made $12,000 on $400,000 invested.

This is the wealth-building engine that helps homeowners accelerate their financial growth faster than renters or cash investors who tie up their capital.

Closing Thoughts

Leverage is one of the most powerful and misunderstood tools available to everyday homebuyers. Used wisely, it can help families build long-term wealth far more efficiently than saving alone. If you’d like to see how leverage might apply to your personal financial picture, I’m always here to walk you through it in a simple, educational way.

The information provided is for educational purposes only and should not be considered financial, investment, or legal advice. All numbers, examples, and scenarios are illustrative only and not guaranteed; results may vary based on borrower qualifications, loan program requirements, and market conditions. The views and opinions expressed are those of the author and do not necessarily reflect the views of CrossCountry Mortgage, LLC (“CrossCountry”).