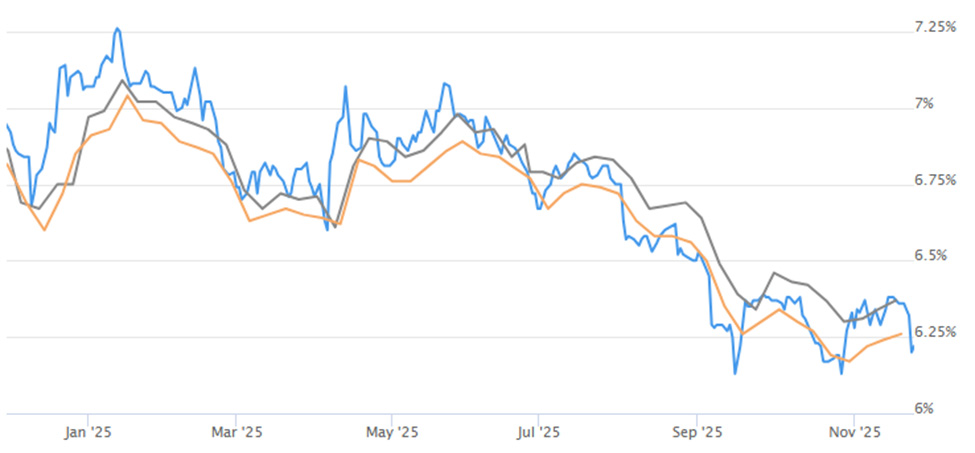

After two years of uninspiring mortgage rates, 2025 is ending with some cautious optimism. Rates have dipped below their peaks but remain above pre-pandemic lows and buyers are asking what 2026 will bring.

The first thing I want my clients to understand: we are not likely to see 2% rates again in our lifetime. While we have some cautious optimism towards money being potentially cheaper in 2026, that doesn’t mean we expect to see rates anywhere near COVID levels…ever.

The Numbers Right Now

- U.S. 30-year fixed average: ~6.3% (Freddie Mac, November 2025)

- Down from ~7.8% highs in late 2024

- Refinance average nationally: 6.4%, but falling slightly this week.

What’s Driving These Rates

- Inflation cooling but still above the Fed’s 2% target. Inflation is an enemy of lower interest rates.

- Federal Reserve keeping policy steady- fewer expected cuts although a December rate cut is still widely expected. We’ll see the impact of the Fed Chair selection as it plays out.

- Bond yields remain elevated, which means those that trade in long-term debt contracts are not buying notes without higher returns. This keeps mortgage rates higher.

Forecasts for 2026

- Most analysts project 6.0–6.25% range for much of 2026. Some predictions slightly more optimistic.

- Limited Fed drops unless inflation sharply declines

- Slightly easier lending conditions expected in Q2–Q3 2026

What does this mean? Without a drastic rate drop on the horizon, buyers aren’t likely to come off the fence in droves. This means less competition for active listings, more average days on market, and potential for buyers to find value through seller concessions. The best thing as a buyer when you find a house you love? Nobody else trying to buy it!

The information, views and opinions expressed in this blog are those of the author, and do not necessarily reflect the views or positions of CrossCountry Mortgage, LLC.** (Chart source: Mortgage New Daily)